city & country-side merges

more complex relationships

an emergent desire of life debureaucratization

trust distributed in network systems

ficticious money

Plastic

the

era

04.

In 1971, Richard Nixon declares the end of the metal ballasts inaugurating the economic hegemony of the dollar. By the end of the century, there were nearly two hundred national currencies, but the most dramatic shift of the age has been the widespread of fictitious money.

Credit

a new era for

As systems of trust evolve, a network of lenders begins to develop. They provide resources to borrowers with interest.

Banks

consolidation of

By connecting lenders with borrowers, banks create new markets and establish themselves as predominant economic intermediaries

Fiat money

standard

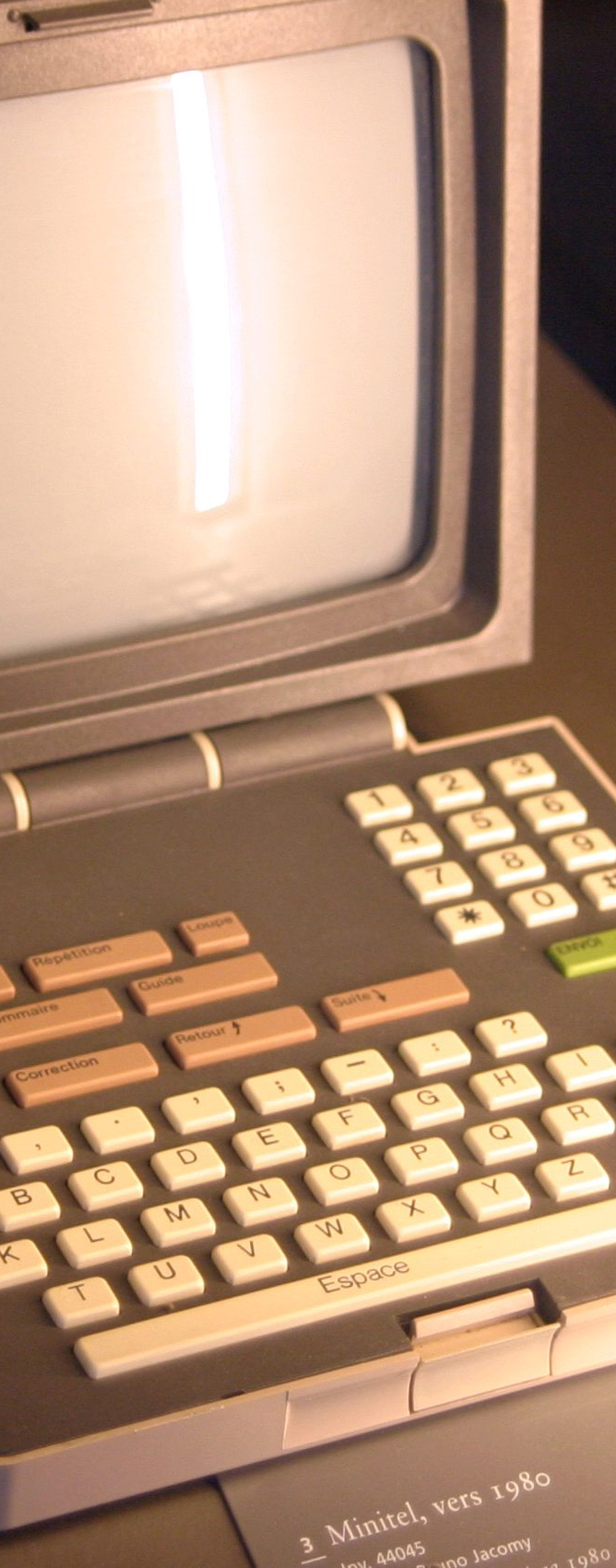

Paper, coins and cheques - items without intrinsic value - emerge as symbolic

standards for global trade

exchange of

Stocks & bonds

by allowing investment in equity stakes of governments and incorporated business, stocks and bonds accelerate the capitalization of centrally organized institutions

from the ubiquitous U.S. dollar to local currencies, with no circulation outside the area controlled by their own national governments.

The currency market differs from all others in an even more fundamental way.

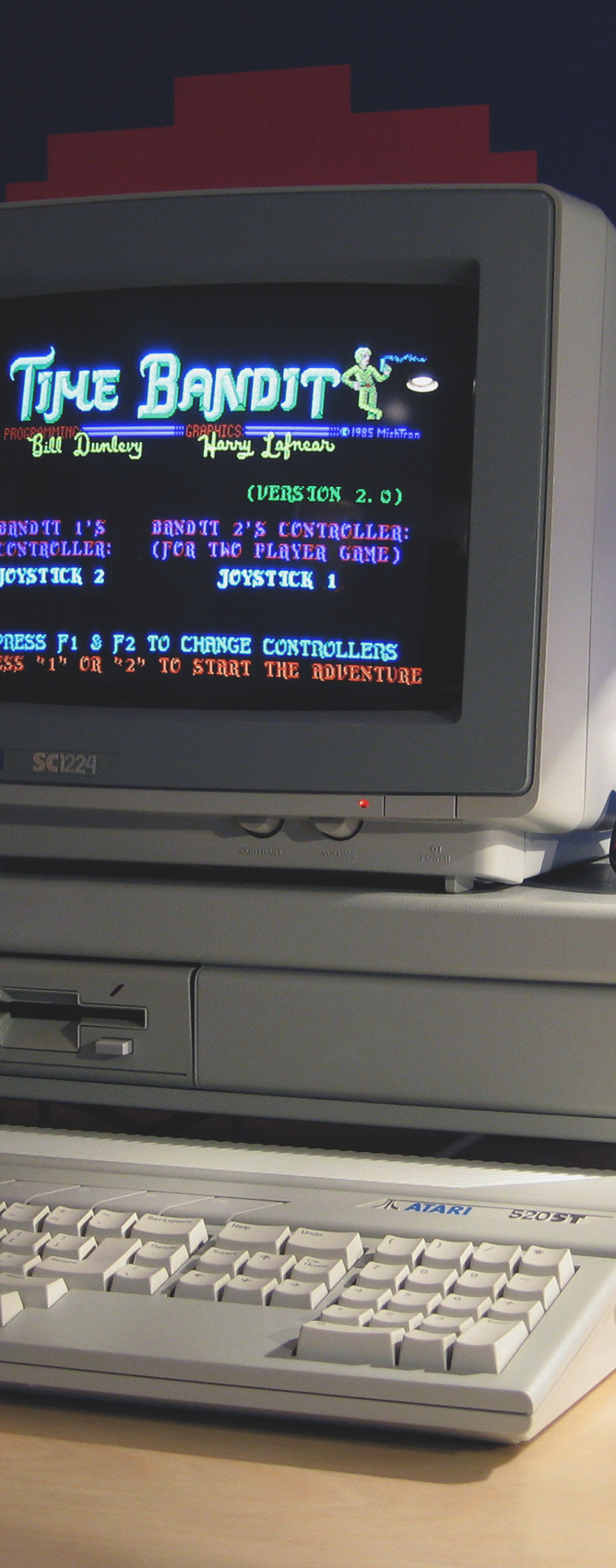

It is now powered by the Third Industrial Revolution.

On May 16, 1972, the Chicago “money pit” opened as the first currency futures market. With the help of computers and satellites, money moved around the world at an accelerated speed, its Promethean energy finally and fully unbound.

IMM opening day

-

+

the third

industrial revolution

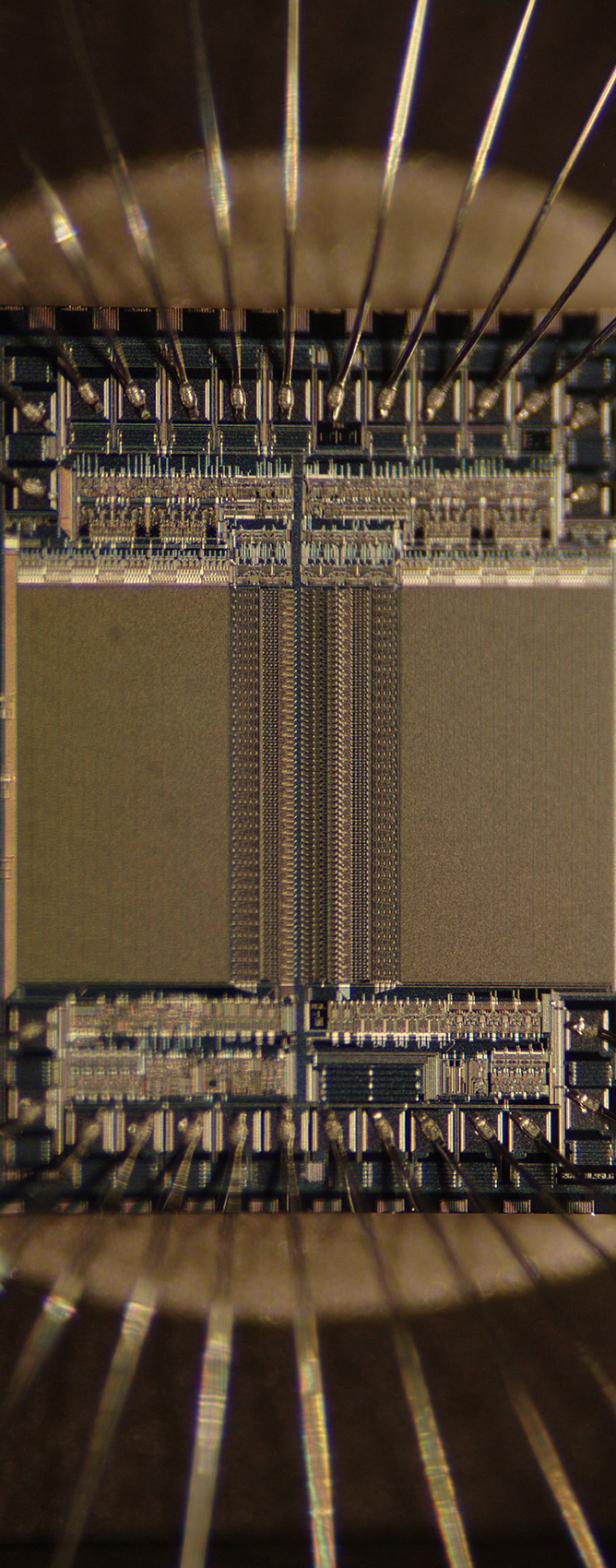

The third industrial revolution or digital revolution which came in the 1980th brought computerisation, i.e. mainframe computers, personal computers, internet, and the information and communication technology (ICT) available today.

In other markets, merchants exchange goods for money; but in the currency market, traders exchange the money of one country for the money of another, with no other goods involved in the transaction.

They do not need to discuss metric versus American measurements, preferred voltage, or shipping lines; they need only haggle about the asking price.

Without the need to plant

and harvest crops, or to manufacture and ship goods, the currency market suffers

no delays; transactions are instantaneous and electronic, the purest exchange of all.

$3 trillion dollars

The largest market in the world, the currency exchange has a daily turnover of more than

By allowing investment in equity stakes of governments and incorporated business, stocks and bonds accelerate the capitalization of centrally organized institutions.

Access to credit allows nations, trade routes and companies to grow while concentrating power. In great symbiosis, banks and governments

power the global economy

to unforeseen prosperity.

Atop of extraordinary wealth, centralized institutions

become the de facto standards for governance.

Barbara Kruger, Untitled (Money can buy you love), 1985.

Collage. Courtesy of Sprüth Magers, Berlin and London.

The rise of internet

The globalization

of money and trade culminates with the use

of internet, by creating

a financial network of unprecedented scale, complexity and richness.

This

changes

everything.

Future of

payment

methods

Envisioning.io